Hi folks, I hope you all are doing good.

How much does it cost to build a crypto exchange with very good security?”.

Generally, there are 2 possible way to launch your exchange platform

If you develop your exchange from scratch, you might face some technical & non-technical issues like crypto wallet integration, partnering with the bank, no beta test, high-cost ($ 50k or more than that), need more time, & a lot of security risk [Sometimes dark world peoples may hack your exchange platform] so most of the crypto enthusiast doesn’t prefer this method.

If you go with white label crypto exchange software, you have a lot of benefits.

Benefits of White Label Crypto Exchange:

It’s very impressive right!!! But all white label crypto exchange software providers are not offering all these services. Only noted crypto exchange software providers like Coinsclone, offering all these services at a budget-friendly price, to know the exact price check here >>> cost to build a cryptocurrency exchange

Or else, you can speak with their business experts directly. Get in touch via,

Whatsapp/Telegram: +919500575285

Mail: [email protected]

Skype: live:hello_20214

For a Free Live Demo, visit @ White Label Crypto Exchange Software

Recently any entrepreneurs interested in starting their bitcoin exchange business, because of the last year 2020, covid -19 totally reshaped the business industry. At that time only businesses were successfully run without any interpretation like “

Crypto Exchange”.Crypto trading is growing rapidly worldwide. Traders who cannot analyze the market in detail may take the help of trading robots to find the best trading opportunities. Read the Trading Robots Vergleich blog to find the best trading bots in the market. So many entrepreneurs & startups were interested to launch their own exchange platform. But they all have one question.

How much does it cost to build a crypto exchange with very good security?”.

Generally, there are 2 possible way to launch your exchange platform

- Developed from scratch

- Launch your exchange by using white label crypto exchange software

If you develop your exchange from scratch, you might face some technical & non-technical issues like crypto wallet integration, partnering with the bank, no beta test, high-cost ($ 50k or more than that), need more time, & a lot of security risk [Sometimes dark world peoples may hack your exchange platform] so most of the crypto enthusiast doesn’t prefer this method.

If you go with white label crypto exchange software, you have a lot of benefits.

Benefits of White Label Crypto Exchange:

- Customizing options - They will help you to build your cryptocurrency exchange platform based on your business needs.

- Monitor and Engage - You can easily monitor the work process

- Beta module - You can test your exchange in the Beta module

- Cost-effective - White label crypto exchange cost of development will be around $ 8k - 15k (It may vary based on the requirements.)

- Time-Period - You can launch your exchange within 1 week

- Fully secured, bug-free & adv trading features.

- Multi-language

- IEO launchpad,

- Crypto wallet,

- Instant buying/selling cryptocurrencies

- Staking and lending

- Live trading charts with margin trading API and futures 125x trading

- Stop limit order and stop-loss orders

- Limit maker orders

- Multi-cryptocurrencies Support

- Referral options

- Admin panel

- Perpetual swaps

- Advanced UI/UX

- Security Features [HTTPs authentication, Biometric authentication, Jail login, Data encryption, Two-factor authentication, SQL injection prevention, Anti Denial of Service(DoS), Cross-Site Request Forgery(CSRF) protection, Server-Side Request Forgery(SSRF) protection, Escrow services, Anti Distributed Denial of Service]

It’s very impressive right!!! But all white label crypto exchange software providers are not offering all these services. Only noted crypto exchange software providers like Coinsclone, offering all these services at a budget-friendly price, to know the exact price check here >>> cost to build a cryptocurrency exchange

Or else, you can speak with their business experts directly. Get in touch via,

Whatsapp/Telegram: +919500575285

Mail: [email protected]

Skype: live:hello_20214

For a Free Live Demo, visit @ White Label Crypto Exchange Software

Read More, Posted by: coinsbot

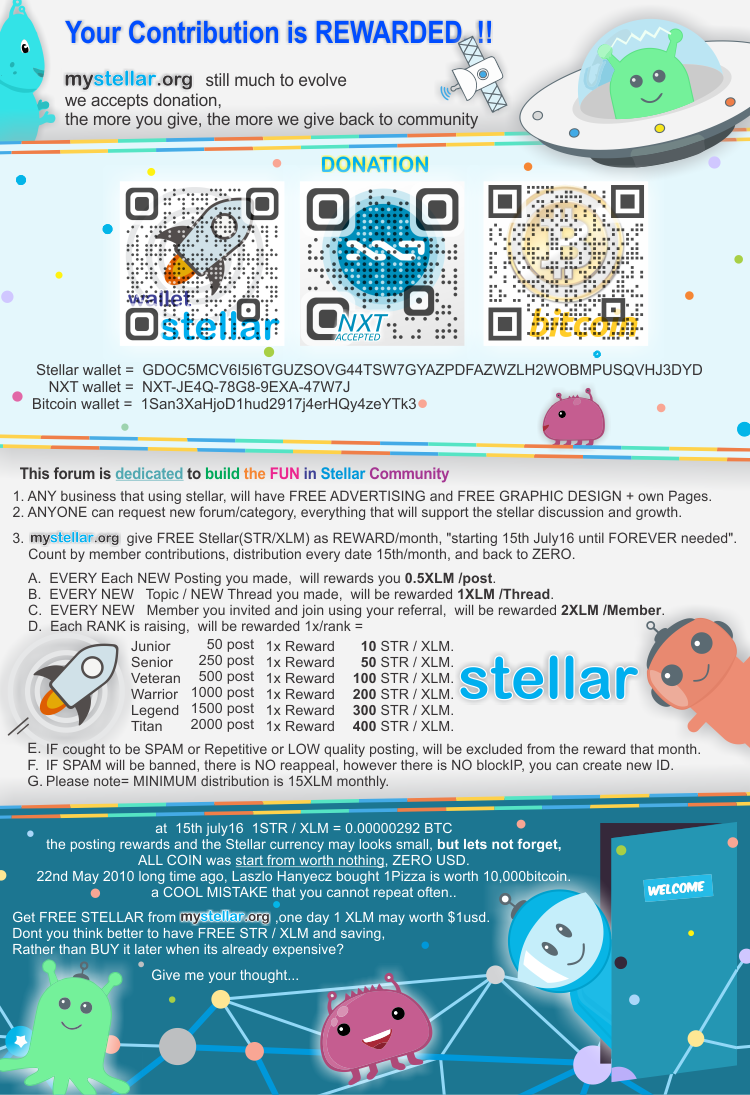

Read More, Posted by: coinsbot Quote: KuCoin is the most advanced and secure cryptocurrency exchange to buy and sell Bitcoin, Ethereum, Litecoin, TRON, USDT, NEO, XRP, KCS, and more.

If you don't have account, you can join here: https://www.kucoin.com/#/?r=1f8f4

non ref: kucoin.com

KuCoin has Auto Trading Bot will help you earn 1% -5% profit everyday.

1. Download and install app: https://www.kucoin.com/download

2. Open app and login your account.

3. Chose Trading Bot:

4. Chose Classic Grid

5. You can see top Trading Bot. You can copy or create new Bot.

6. Input AI Parameters and create Trading Bot

Note: When market is unstable and down, you may stop your Bot to get your profit. And start your Trading Bot again when market is up trend.

I run 6 Trading Bot and my profit:

Read More, Posted by: cryptocoins

Read More, Posted by: cryptocoins Recently, NFT has become the talk of the town so much that its boom is in full force. Its widespread impact hasn’t gone unnoticed as celebrities, big brands, and athletes mint their own NFTs to take advantage of the latest crypto trend. The trend is now lucrative such that everyone is looking for an opportunity to make millions through the process.

However, if you are a creative artist, it can be difficult to mint and sell your piece of art as NFTs because of the cumbersome process of navigating through the NFT Blockchain. How can these creators mint and sell their NFTs?

![[Image: LEzH8l6.png]](LEzH8l6.png)

If, as an artist, that has been your major concern, there is nothing to worry about because ARTDECO is designed to make the process easy. ARTDECO is an Elon Musk inspired community-driven decentralized finance (DeFi) platform that comes with a unique decentralized NFT Minting Protocol for creative artists to convert their arts and collectibles into NFTs.

NFT Minting & NFT Marketplace

The ARTDECO project comprises two aspects, which are the NFT Minting and the NFT Marketplace. The NFT Minting acts like a digital container designed to hold your unique and priceless collectible. For instance, the first jersey Leo Messi worn, the signature of Abraham Lincoln, or a video you shot 40 years ago.

However, the NFT Marketplace allows everyone to mint and sell their NFTs. Even if you love art but have financial constrain buying popular arts, the ARTDECO NFT Marketplace allows you to create and sell your NFTs. Interestingly, anyone can make money from the ARTDECO platform either by minting or selling.

ARTDECO Platform – Mint and Sell your NFT projects

The ARTDECO platform is a web-based NFT creation and minting platform that allows everyone with internet access to upload their unique art piece and convert it into a Binance-based NFTs without any smart code contracts.

Each NFT project has its unique token on the Blockchain, with the creator and successive holder having 100% verifiable ownership of the project. All that is required is to upload your creative work (Music, Photo, or Drawing), including a description, selling price, and the ArtDeco app will issue it using the BEP-721 token format on the Binance Blockchain.

Public Sales of ARTDECO Token

Currently, ARTDECO is launching the public sales of its unique token, which will be used within the ARTDECO Marketplace. The token is available on sale on the Bounce Finance platform, with a maximum allocation of 500 million ARTDECO.

The purpose of the public sale is to help raise liquidity to fund the development of the ART DECO decentralized Web 3.0 NFT Marketplace on DeFi exchanges and top-tier centralized exchanges. The public sale is scheduled to last for 40 days or pending when it has achieved its goal.

The Sale aims to raise liquidity to fund the ARTDECO development of Our Decentralized Web 3.0 NFT Marketplace on DEFI Exchanges and top-tier centralized exchanges.

Artdeco is currently conducting a public sale of 10% of its Total Supply on Bounce Finance at the price of $0.0003. Buying possible from https://artdecotoken.gitbook.io/artdeco/...uy-artdeco

Contract Address: 0x6515A41578BB7Ad5486b96384E4148E7844F3D70

More Information At:

Website: https://artdeco.community

Telegram: https://t.me/artdecocoin

Facebook: https://fb.me/artdecobsc/

Twitter: https://twitter.com/artdecobsc

Medium: https://artdecotoken.medium.com/

Instagram: https://www.instagram.com/artdecobsc/

However, if you are a creative artist, it can be difficult to mint and sell your piece of art as NFTs because of the cumbersome process of navigating through the NFT Blockchain. How can these creators mint and sell their NFTs?

![[Image: LEzH8l6.png]](LEzH8l6.png)

If, as an artist, that has been your major concern, there is nothing to worry about because ARTDECO is designed to make the process easy. ARTDECO is an Elon Musk inspired community-driven decentralized finance (DeFi) platform that comes with a unique decentralized NFT Minting Protocol for creative artists to convert their arts and collectibles into NFTs.

NFT Minting & NFT Marketplace

The ARTDECO project comprises two aspects, which are the NFT Minting and the NFT Marketplace. The NFT Minting acts like a digital container designed to hold your unique and priceless collectible. For instance, the first jersey Leo Messi worn, the signature of Abraham Lincoln, or a video you shot 40 years ago.

However, the NFT Marketplace allows everyone to mint and sell their NFTs. Even if you love art but have financial constrain buying popular arts, the ARTDECO NFT Marketplace allows you to create and sell your NFTs. Interestingly, anyone can make money from the ARTDECO platform either by minting or selling.

ARTDECO Platform – Mint and Sell your NFT projects

The ARTDECO platform is a web-based NFT creation and minting platform that allows everyone with internet access to upload their unique art piece and convert it into a Binance-based NFTs without any smart code contracts.

Each NFT project has its unique token on the Blockchain, with the creator and successive holder having 100% verifiable ownership of the project. All that is required is to upload your creative work (Music, Photo, or Drawing), including a description, selling price, and the ArtDeco app will issue it using the BEP-721 token format on the Binance Blockchain.

Public Sales of ARTDECO Token

Currently, ARTDECO is launching the public sales of its unique token, which will be used within the ARTDECO Marketplace. The token is available on sale on the Bounce Finance platform, with a maximum allocation of 500 million ARTDECO.

The purpose of the public sale is to help raise liquidity to fund the development of the ART DECO decentralized Web 3.0 NFT Marketplace on DeFi exchanges and top-tier centralized exchanges. The public sale is scheduled to last for 40 days or pending when it has achieved its goal.

The Sale aims to raise liquidity to fund the ARTDECO development of Our Decentralized Web 3.0 NFT Marketplace on DEFI Exchanges and top-tier centralized exchanges.

Artdeco is currently conducting a public sale of 10% of its Total Supply on Bounce Finance at the price of $0.0003. Buying possible from https://artdecotoken.gitbook.io/artdeco/...uy-artdeco

Contract Address: 0x6515A41578BB7Ad5486b96384E4148E7844F3D70

More Information At:

Website: https://artdeco.community

Telegram: https://t.me/artdecocoin

Facebook: https://fb.me/artdecobsc/

Twitter: https://twitter.com/artdecobsc

Medium: https://artdecotoken.medium.com/

Instagram: https://www.instagram.com/artdecobsc/

Read More, Posted by: Milner

Read More, Posted by: Milner The cryptocurrency marketplace is one of the largest financial markets in the world. The evolution of blockchain technology allows investors and crypto enthusiasts to trade cryptocurrencies, farm, and lend tokens to earn a decent profit. In this vast ecosystem, one aspect that has gained significant attention is the concept of crypto presales. Presales often provide an opportunity for early investors to acquire tokens at a discounted price. The Shiba Inu presale created a buzz among crypto enthusiasts, attracting attention from both seasoned investors and newcomers alike. At the center of this is Moments Global, a project designed to create different variations of blockchain.

At its core, Moments Global allows developers to build applications using MMC Chain's foundation. With its decentralized marketplace, users can build payment apps and participate in loans and savings schemes.

![[Image: CfcVj2u.jpg]](CfcVj2u.jpg)

Different Products Developed By Moments

To achieve the aim of creating a separate blockchain for members of the MMC Chain community, the team at Moments created a number of project, including the following:

1. MMC Utility Token

The MMC token is a utility token that users can use to buy goods and services on the Moments protocol. Users can also use the MMC token to pay transaction fees when making cross-border payments. In general, the token was issued to drive the operations of the company.

2. MMC DEX

MMC DEX is a decentralized exchange where traders can buy and sell different cryptocurrencies, including the MMC token. Traders can also participate in derivatives trading on MMC DEX.

3. MMC Investments

Moments has investment schemes where members of the MMC Chain community can invest their hard-earned money to make passive income and achieve their income projections.

About Moments

Moments is a leading global financial group offering various financial services to a wide range of clients. Moments allows crypto enthusiasts to build decentralized applications, trade and make payments in cryptocurrencies, and lend money from other people on the network. It also provides crypto derivative services to its clients spread across 42 nations of the world.

The team at Moments has one clear mission - to develop a separate blockchain that allows developers to develop applications using MMC Chain's foundation. Moments leverages blockchain technology to bring decentralized finance to their MMC Chain community. Members of the community will be rewarded for their active participation in the project. Moments parades a team of technocrats who have vast experience in blockchain development, marketing, supply chain, and digital marketing. Since the inception of the company, it has initiated and completed more than 280 projects.

Contact Info:

Website: https://moments.global/

Telegram: https://t.me/Moment_Community

Facebook: https://web.facebook.com/momentecosystem/

Twitter: https://twitter.com/MomentEcosystem

YouTube: https://www.youtube.com/channel/UCUklt3f...4W7NNkpz5w

At its core, Moments Global allows developers to build applications using MMC Chain's foundation. With its decentralized marketplace, users can build payment apps and participate in loans and savings schemes.

![[Image: CfcVj2u.jpg]](CfcVj2u.jpg)

Different Products Developed By Moments

To achieve the aim of creating a separate blockchain for members of the MMC Chain community, the team at Moments created a number of project, including the following:

1. MMC Utility Token

The MMC token is a utility token that users can use to buy goods and services on the Moments protocol. Users can also use the MMC token to pay transaction fees when making cross-border payments. In general, the token was issued to drive the operations of the company.

2. MMC DEX

MMC DEX is a decentralized exchange where traders can buy and sell different cryptocurrencies, including the MMC token. Traders can also participate in derivatives trading on MMC DEX.

3. MMC Investments

Moments has investment schemes where members of the MMC Chain community can invest their hard-earned money to make passive income and achieve their income projections.

About Moments

Moments is a leading global financial group offering various financial services to a wide range of clients. Moments allows crypto enthusiasts to build decentralized applications, trade and make payments in cryptocurrencies, and lend money from other people on the network. It also provides crypto derivative services to its clients spread across 42 nations of the world.

The team at Moments has one clear mission - to develop a separate blockchain that allows developers to develop applications using MMC Chain's foundation. Moments leverages blockchain technology to bring decentralized finance to their MMC Chain community. Members of the community will be rewarded for their active participation in the project. Moments parades a team of technocrats who have vast experience in blockchain development, marketing, supply chain, and digital marketing. Since the inception of the company, it has initiated and completed more than 280 projects.

Contact Info:

Website: https://moments.global/

Telegram: https://t.me/Moment_Community

Facebook: https://web.facebook.com/momentecosystem/

Twitter: https://twitter.com/MomentEcosystem

YouTube: https://www.youtube.com/channel/UCUklt3f...4W7NNkpz5w

Read More, Posted by: Milner

Read More, Posted by: Milner We all know the world is moving towards a digital ecosystem. In the ecosystem, Cryptocurrencies are playing an important role. Recently (Mar’2021), statistical reports say “more than 69.96 million active crypto users around the worldwide”. And now countries have legalized cryptocurrency.

Day-by-Day, cryptocurrency market is enlarging very fast, as a many new business opportunities are ahead such as crypto token creation, crypto exchange (Centralized & Decentralized), Crypto lending & borrowing, crypto wallet creation, crypto gaming & now Cryptocurrency Payment Gateway. Among these business ideas, recently we can find that many startups & entrepreneurs picked one particular business, that is - Cryptocurrency Payment Gateway.

The count of 69.96 million active crypto users creates this much curiosity to the crypto payment gateway. And, many industries like travel, clothing, food, etc. have already started accepting crypto payments(to cover the worldwide audience).

So, have you been wondering how to create a cryptocurrency payment gateway processor??? Let me explain in simple steps,

There are some certain that you need to follow to build/create a successful cryptocurrency payment gateway platform.

These are some steps you need to follow to launch a cryptocurrency payment gateway processor. Choosing the cryptocurrency payment gateway software/script providers is very important. Because many cryptocurrency payment gateway software firms are available in the crypto market. So picking the best cryptocurrency payment gateway software is a really tough job. Don't worry; I will help you. I’ve done some technical research to identify & find the best cryptocurrency payment gateway software provider, as the end of the result one script/software provider (Coinsclone) cleared all my technical & non-technical hurdles. Coinsclone is one of the professional crypto exchange clone script providers. Their software/script is 100% secured & bug-free because their primary motto is client stratification. So that they have clients from all over the world. Till now they have successfully delivered 100+ crypto projects (Crypto exchange, Wallets & Payment gateway) for their clients.

Are you interested in shaking hands with them??? Talk with their team of business experts directly via,

Whatsapp/Telegram: +919500575285

Mail: [email protected]

Skype: live:hello_20214

For a Free Live Demo, visit @ Cryptocurrency Payment Gateway Development.

Day-by-Day, cryptocurrency market is enlarging very fast, as a many new business opportunities are ahead such as crypto token creation, crypto exchange (Centralized & Decentralized), Crypto lending & borrowing, crypto wallet creation, crypto gaming & now Cryptocurrency Payment Gateway. Among these business ideas, recently we can find that many startups & entrepreneurs picked one particular business, that is - Cryptocurrency Payment Gateway.

The count of 69.96 million active crypto users creates this much curiosity to the crypto payment gateway. And, many industries like travel, clothing, food, etc. have already started accepting crypto payments(to cover the worldwide audience).

So, have you been wondering how to create a cryptocurrency payment gateway processor??? Let me explain in simple steps,

There are some certain that you need to follow to build/create a successful cryptocurrency payment gateway platform.

- Do some industrial market research

- Choose the location to launch your crypto exchange business

- Partnering with the acquiring bank

- Don’t forget about security & features

- And, Get the Cryptocurrency Payment Gateway Software/Script from the trusted providers.

These are some steps you need to follow to launch a cryptocurrency payment gateway processor. Choosing the cryptocurrency payment gateway software/script providers is very important. Because many cryptocurrency payment gateway software firms are available in the crypto market. So picking the best cryptocurrency payment gateway software is a really tough job. Don't worry; I will help you. I’ve done some technical research to identify & find the best cryptocurrency payment gateway software provider, as the end of the result one script/software provider (Coinsclone) cleared all my technical & non-technical hurdles. Coinsclone is one of the professional crypto exchange clone script providers. Their software/script is 100% secured & bug-free because their primary motto is client stratification. So that they have clients from all over the world. Till now they have successfully delivered 100+ crypto projects (Crypto exchange, Wallets & Payment gateway) for their clients.

Are you interested in shaking hands with them??? Talk with their team of business experts directly via,

Whatsapp/Telegram: +919500575285

Mail: [email protected]

Skype: live:hello_20214

For a Free Live Demo, visit @ Cryptocurrency Payment Gateway Development.

Read More, Posted by: coinsbot

Read More, Posted by: coinsbot The cryptocurrency industry and blockchain technology is set to revolutionize the global industrial landscaping, including the advertisement sub-sector. The advertisement industry presents lots of exciting opportunities for advertisers, digital marketers, and publishers. Millions of cryptocurrency enthusiasts across the world use blockchain technology to build different marketplace; thus, creating unfettered access to financial investments, trust, and opportunity.

While there are a lot of blockchain-powered marketplaces for content creators, advertisers, and publishers, one project that currently revolutionizes the advertisement industry is Advertise Coin.

![[Image: e5vzL5T.jpg]](e5vzL5T.jpg)

Advertise Coin is a fully decentralized marketplace where publishers and advertisers connect to revolutionize the advertisement industry. ADCO is Advertise Coin's utility token. The token can be used to purchase goods and services on the Advertise Coin protocol.

What is Advertise Coin and what do I stand to benefit? Read on to find out!

What Is Advertise Coin?

Advertise Coin (ADCO) is an ERC-20-based token that connects both buyers and sellers in the advertisement industry. Users can exchange ADCO for other cryptocurrencies on different centralized and decentralized exchanges. The focus of the project is to allow content creators to sell their content to their audience with ease.

The team at Advertise Coin consists of competent and experienced marketers, blockchain experts, and seasoned Fintech experts. The team is led by Anton Malinov.

Advertise Coin’s OWN Ad Exchange Platform

Advertise Coin also have its OWN Ad exchange features http://webhit.net, which is currently in developing stages, and is going to be fully launched soon.

Benefits Of Participating In The Project

1. Trust and Transparency

Advertise Coin is transparent. The coin is for everyone involved in the advert industry. The fees charged are moderate - what you see on the screen is what you get.

2. Maximum Security

The team at Advertise Coin uses the latest cutting-edge technology to provide robust security to the network. This means your funds and deposits are safe and secure within the Advertise Coin protocol.

3. Payment Flexibility

Users can use Advertise Coin to pay for goods and services. The payment platform is flexible, as you can also use it to receive payments from your clients.

4. Bonus

Advertise Coin offers bonuses to participants during the token sale. You can withdraw the bonus or use it to buy advertisements on exchanges. ADCO is poised to skyrocket in the coming months.

ADCO is the token for everyone in the advertisement industry. Join now and be part of a growing movement.

Website: http://www.advertisecoin.com

Telegram: https://t.me/advertisecoin

Facebook: https://www.facebook.com/advertisecoin

Twitter: https://twitter.com/advertisecoin

While there are a lot of blockchain-powered marketplaces for content creators, advertisers, and publishers, one project that currently revolutionizes the advertisement industry is Advertise Coin.

![[Image: e5vzL5T.jpg]](e5vzL5T.jpg)

Advertise Coin is a fully decentralized marketplace where publishers and advertisers connect to revolutionize the advertisement industry. ADCO is Advertise Coin's utility token. The token can be used to purchase goods and services on the Advertise Coin protocol.

What is Advertise Coin and what do I stand to benefit? Read on to find out!

What Is Advertise Coin?

Advertise Coin (ADCO) is an ERC-20-based token that connects both buyers and sellers in the advertisement industry. Users can exchange ADCO for other cryptocurrencies on different centralized and decentralized exchanges. The focus of the project is to allow content creators to sell their content to their audience with ease.

The team at Advertise Coin consists of competent and experienced marketers, blockchain experts, and seasoned Fintech experts. The team is led by Anton Malinov.

Advertise Coin’s OWN Ad Exchange Platform

Advertise Coin also have its OWN Ad exchange features http://webhit.net, which is currently in developing stages, and is going to be fully launched soon.

Benefits Of Participating In The Project

1. Trust and Transparency

Advertise Coin is transparent. The coin is for everyone involved in the advert industry. The fees charged are moderate - what you see on the screen is what you get.

2. Maximum Security

The team at Advertise Coin uses the latest cutting-edge technology to provide robust security to the network. This means your funds and deposits are safe and secure within the Advertise Coin protocol.

3. Payment Flexibility

Users can use Advertise Coin to pay for goods and services. The payment platform is flexible, as you can also use it to receive payments from your clients.

4. Bonus

Advertise Coin offers bonuses to participants during the token sale. You can withdraw the bonus or use it to buy advertisements on exchanges. ADCO is poised to skyrocket in the coming months.

ADCO is the token for everyone in the advertisement industry. Join now and be part of a growing movement.

Website: http://www.advertisecoin.com

Telegram: https://t.me/advertisecoin

Facebook: https://www.facebook.com/advertisecoin

Twitter: https://twitter.com/advertisecoin

Read More, Posted by: Milner

Read More, Posted by: Milner With the fast adoption of social media platforms and blockchain technology to promote social products and services, opportunities abound in the crypto ecosystem are certainly unlimited.

In a bid to offer better opportunities to crypto enthusiasts, the team at xHumanity is pleased to announce that new staking and BSC farming are ready and further process can be followed at https://app.xhumanity.org/

Furthermore, BEP20 XDNA deposit is also enabled at BitMart. For BSC farming, you can stake XDNA for up to 266% APY. And for staking, you can stake XDNA up to 149% APY.

![[Image: F4GXVL7.jpg]](F4GXVL7.jpg)

BSC Airdrop

In order to celebrate the new additions, xHumanity is very happy to announce that we are going to do a Giveaway (Airdrop) Event starting from Monday, 3rd May, 2021 with a 5,000 USD reward pool.

xHumanity Vision

xHumanity is born with the hope for a better world. Based on blockchain technology, xHumanity is an application that supports community building and social cross-interaction in both online and offline environments and distribute equity rewards.

The mandate of xHumanity is to revolutionize the present-day social media landscape, by reinventing human values and algorithms to create a better and more transparent social community where each member would be able to vote in the direction of a project.

xHumanity looks to leverage the power of blockchain technology as it is a technology that looks set to have the potential of contributing to the evolution of the Next Generation Internet and a viable tool to achieving high levels of Distributed Trust seamlessly and unobtrusively.

About xHumanity

xHumanity is an innovative blockchain project and a social community where users are empowered to leverage on the gains of social media marketing. Whether you are a new user or you have been on the xHumanity protocol for some time now, the project helps to interact with like-minded individuals, freely air your views, and network with celebrities.

xHumanity directly connects to centralized social networking platforms like Twitter, YouTube, Instagram, Facebook, and LinkedIn. Investors looking for where to earn a decent ROI can farm, lend, and stake their capital to earn xDNA tokens.

More Information at:

Website: https://xhumanity.org/

ETH Explorer: https://etherscan.io/token/0x8e57c27761E...B51a358AbB

BSC Explorer: https://bscscan.com/token/0x80dba9c32b7a...24c0ba4c24

In a bid to offer better opportunities to crypto enthusiasts, the team at xHumanity is pleased to announce that new staking and BSC farming are ready and further process can be followed at https://app.xhumanity.org/

Furthermore, BEP20 XDNA deposit is also enabled at BitMart. For BSC farming, you can stake XDNA for up to 266% APY. And for staking, you can stake XDNA up to 149% APY.

![[Image: F4GXVL7.jpg]](F4GXVL7.jpg)

BSC Airdrop

In order to celebrate the new additions, xHumanity is very happy to announce that we are going to do a Giveaway (Airdrop) Event starting from Monday, 3rd May, 2021 with a 5,000 USD reward pool.

xHumanity Vision

xHumanity is born with the hope for a better world. Based on blockchain technology, xHumanity is an application that supports community building and social cross-interaction in both online and offline environments and distribute equity rewards.

The mandate of xHumanity is to revolutionize the present-day social media landscape, by reinventing human values and algorithms to create a better and more transparent social community where each member would be able to vote in the direction of a project.

xHumanity looks to leverage the power of blockchain technology as it is a technology that looks set to have the potential of contributing to the evolution of the Next Generation Internet and a viable tool to achieving high levels of Distributed Trust seamlessly and unobtrusively.

About xHumanity

xHumanity is an innovative blockchain project and a social community where users are empowered to leverage on the gains of social media marketing. Whether you are a new user or you have been on the xHumanity protocol for some time now, the project helps to interact with like-minded individuals, freely air your views, and network with celebrities.

xHumanity directly connects to centralized social networking platforms like Twitter, YouTube, Instagram, Facebook, and LinkedIn. Investors looking for where to earn a decent ROI can farm, lend, and stake their capital to earn xDNA tokens.

More Information at:

Website: https://xhumanity.org/

ETH Explorer: https://etherscan.io/token/0x8e57c27761E...B51a358AbB

BSC Explorer: https://bscscan.com/token/0x80dba9c32b7a...24c0ba4c24

Read More, Posted by: Milner

Read More, Posted by: Milner  Read More, Posted by: karansahani

Read More, Posted by: karansahani Great opportunity to earn $200 free. Get 200 CIN coin.

Sign up on coinsbit and complete your kyc.

Click here to sign up

Sign up on coinsbit and complete your kyc.

Click here to sign up

Read More, Posted by: karansahani

Read More, Posted by: karansahani ![[Image: PWhmuCD.jpg]](PWhmuCD.jpg)

Bitcoin continues to hit ATH, and the market is on fire. To give back to our global communities, (BitMart will offer "trade mainstream cryptos to share 9,000 USDT" event. Participate in the trading of BTC, ETH, LTC, BCH, DOGE, XRP, VET, and DASH during the event, and you will get the opportunity to share 9,000 USDT rewards.

1. Welcome Bonus - Trade Mainstream Cryptos to Share 3,000 USDT

During the event period, new users register on (BitMart to complete KYC, and achieve a trading volume of no less than 100 USDT (including buy and sell orders) for the specified trading pair will receive 5 USDT each and will receive extra 5 USDT rewards after achieving a trading volume on any 2 days during the event period. The total prize pool is 3,000 USDT, first-come, first-served.

Register link: https://h5.bitmart.com/invite-gift/en?r=P4CxMC&u=+

*Example: User A registered on BitMart on April. 21, and achieved a total trading volume of specified trading pairs no less than 100 USDT in April. 21 and April. 23, user A will receive 10 USDT rewards.

2. Present Users - Trade Mainstream Cryptos to Share 3,000 USDT

During the event period, users will be calculated in terms of the total specified trading pairs volume traded on their BitMart accounts (including both buy and sell orders) among all specified trading pairs volume during the event period. We will distribute the 3,000 USDT proportionally according to each user's specified trading pairs trading volume compared to the total amount of specified trading pairs Trading Volume traded by all users on BitMart.

3. Present Users - Trade Mainstream Cryptos to Share 3,000 USDT

1st: 1,000 USDT

2nd: 500 USDT

3rd: 300 USDT

4th-20th: split 1,200 USDT proportionally

Join now before its too late!

Read More, Posted by: Milner

Read More, Posted by: Milner ![[Image: Jx68lIn.png]](Jx68lIn.png)

African businesses and entrepreneurs have for long remained under the shackles of the government and financial institutions when sending or receiving cross-border payments. In fact, payment gateways like PayPal blacklisted most African countries from enjoying their full services like receiving payment from customers. The payment merchant linked this to the issue of fraud and dishonesty among African entrepreneurs.

On the other hand, financial institutions impose heavy fees to make funds transfer overseas. Imagine you have a supplier in China who supplies you raw materials for your plant to run, the charges you'd be paying as fees to banks is almost the same as the cost of producing a single unit of your product. This was the reality that most production businesses in Africa pass through until the evolution of blockchain technology.

The Blockchain technology now enables payment merchants to bypass financial institutions and even the government when sending or receiving cross-border payments. While there are several merchants leveraging blockchain technology to facilitate cross-border payment, Afripay is the first to hit the African ecosystem. The mission of the company is to free Africans and African businesses from the shackles of the government and financial institutions.

What Is Afripay?

Afripay is a blockchain-powered payment gateway and the first in Africa to provide financial services leveraging blockchain technology. Afripay parades a team of experienced personnel with vast years of experience in the Fintech industry. Among others, there are Blockchain experts, financial analysts, and experienced marketers in the team.

Unlike other payment processors like PayPal, Perfect Money, and Skrill, Afripay leverages blockchain to free Africans and businesses in Africa from the stronghold of financial institutions. With Afripay's token, APAY, businesses can send and receive cross-border payments without hassles.

Why Should I Use Afripay For My Business?

Being a first-of-its-kind payment gateway in Africa, Afripay promises African businesses seamless financial services. Here are some reasons why you should integrate Afripay into your businesses:

● Swift Payment: If you need to send or receive payments from your clients wherever they may live, you can use Afripay to achieve that.

● Secure Payment: You must have heard stories of people losing their hard-earned due to security breaches, which is not the case with Afripay. The company uses cutting-edge technology to protect users' funds.

● Expert Team: Afripay parades a team of experienced and competent marketers, blockchain enthusiasts, and financial analysts. With the team on the ground, all the questions bothering you would be addressed.

Afripay Tokensale

APAY ($APAY) is the utility token that Powers the Afripay decentralized payment solution. APAY can be used to initiate and receive payments between Merchants and customers in Africa, allowing them to transact securely with low transaction fees. The Token Sale progress is moving at a rapid pace, and can be joined through https://sales.afripay.io/

Furthermore, the private sales are making much bigger mark with generating 30,000 USD raised during the private funding round.

Closing out:

Are you looking to use Afripay to send and receive cross-border payments? Then visit https://afripay.io for more information. You can reach the Afripay customer support team via their https://t.me/afripayfinance

Read More, Posted by: Milner

Read More, Posted by: Milner ![[Image: NgisTVt.jpg]](NgisTVt.jpg)

With the Rapid growth in Crypto industry, xHumanity too aims for the piece of cake, the team announces the new listing at BiKi exchange.

BiKi will list extraDNA (XDNA) on their digital assets platform on 19th April, 2021. The following trading pair will be available: XDNA/USDT. Please note the available dates for different functions below:

Schedule for Functions Opening

1. Opening time for deposit: 4/19, 15:00 (GMT +8)

2. Opening time for trading: 4/19, 20:00 (GMT +8)

3. Opening time for withdrawal: 4/20, 15:00 (GMT +8)

https://www.biki.com/en_US/noticeInfo/4849

Coin Info

Token Name: extraDNA

Token Symbol: XDNA

Token Type: ERC20

Total Supply: 11,000,000,000 XDNA

Circulating Supply: 1,890,741,037 XDNA

Prior to now, xHumanity has already been listed on a number of exchanges, including BitMart, Probit, EMISWAP, UNISWAP, and PancakeSwap.

In recent times, xHumanity has gained tremendous traction compared to other blockchain-powered projects that started the same time with it.

The mandate of xHumanity is to revolutionize the present day social media landscape. With intend to achieve this by reinventing human values and algorithms to create a better and transparent social community where each member would be able to vote on the direction of the project.

About xHumanity

xHumanity is a blockchain-powered social community developed to empower individuals and businesses to fully take advantage of social media networking. Users on the xHumanity platform can freely air their views, network with like-minded people from across the world, and associate with public figures.

xHumanity directly connects to centralized social networking platforms like Twitter, YouTube, Instagram, Facebook, and LinkedIn. Investors looking for where to earn a decent ROI can farm, lend, and stake their capital to earn xDNA tokens.

More Information at: https://xhumanity.org/

Twitter: https://twitter.com/xHumanity1

Telegram: https://t.me/xHumanity

Linkedin: https://www.linkedin.com/company/xhumanity/

Facebook: https://www.facebook.com/xHumanityofficial

Explorer: https://etherscan.io/token/0x8e57c27761E...B51a358AbB

Read More, Posted by: Milner

Read More, Posted by: Milner ![[Image: NgisTVt.jpg]](NgisTVt.jpg)

With the Rapid growth in Crypto industry, xHumanity too aims for the piece of cake, the team announces the new listing at BiKi exchange.

BiKi will list extraDNA (XDNA) on their digital assets platform on 19th April, 2021. The following trading pair will be available: XDNA/USDT. Please note the available dates for different functions below:

Schedule for Functions Opening

1. Opening time for deposit: 4/19, 15:00 (GMT +8)

2. Opening time for trading: 4/19, 20:00 (GMT +8)

3. Opening time for withdrawal: 4/20, 15:00 (GMT +8)

https://www.biki.com/en_US/noticeInfo/4849

Coin Info

Token Name: extraDNA

Token Symbol: XDNA

Token Type: ERC20

Total Supply: 11,000,000,000 XDNA

Circulating Supply: 1,890,741,037 XDNA

Prior to now, xHumanity has already been listed on a number of exchanges, including BitMart, Probit, EMISWAP, UNISWAP, and PancakeSwap.

In recent times, xHumanity has gained tremendous traction compared to other blockchain-powered projects that started the same time with it.

The mandate of xHumanity is to revolutionize the present day social media landscape. With intend to achieve this by reinventing human values and algorithms to create a better and transparent social community where each member would be able to vote on the direction of the project.

About xHumanity

xHumanity is a blockchain-powered social community developed to empower individuals and businesses to fully take advantage of social media networking. Users on the xHumanity platform can freely air their views, network with like-minded people from across the world, and associate with public figures.

xHumanity directly connects to centralized social networking platforms like Twitter, YouTube, Instagram, Facebook, and LinkedIn. Investors looking for where to earn a decent ROI can farm, lend, and stake their capital to earn xDNA tokens.

More Information at: https://xhumanity.org/

Twitter: https://twitter.com/xHumanity1

Telegram: https://t.me/xHumanity

Linkedin: https://www.linkedin.com/company/xhumanity/

Facebook: https://www.facebook.com/xHumanityofficial

Explorer: https://etherscan.io/token/0x8e57c27761E...B51a358AbB

Read More, Posted by: Milner

Read More, Posted by: Milner 2021 has been a really memorable year for me, it is for many reasons, but most important is earning wise, as my overall turnout for the year was at peak. I was able to collect over 15k in the year, it might not be huge for many, but given my own experience, it is really huge. Now I wish that with FreshForex broker, I can double/triple this figure by next year, I am really hopeful that I will manage it successfully without any difficulty.

Read More, Posted by: Milner

Read More, Posted by: Milner I believe having low spread means a lot of comfort, if we don’t have low spread then we will get restricted and we will always worry over recovering it, but if we have low spread available then we will be much more open in our style. I trade with FreshForex broker, it is a very fine broker and they got low spread of 0.2 pips for all major pairs while the stop out level too is extremely low at just 15%.

Read More, Posted by: Milner

Read More, Posted by: Milner |

FINANCE with a MISSION to FIGHT POVERTY

|

|

|

Help us Spread the News and Stellar Lumens XLM (Formerly known as STR)

|

|

HOME

HOME  FORUM

FORUM

Stellar Lounge

Stellar Lounge Search

Search Community

Community  Members

Members Stats

Stats Forum Team

Forum Team Todays Posts

Todays Posts View New Posts

View New Posts

Click

Click